Bookkeeping example: The Beginner’s Guide to Bookkeeping

The Purchases account on the chart of accounts tracks goods purchased. This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein.

To do the books for your small business, you need to be aware of all of the different account types. These include accounts payable, inventory, cash and many more that we’ve outlined in this blog. Double-entry bookkeeping produces reports that allow investors, banks, and potential buyers to get an accurate and full picture of the financial health of your business. When you receive the $780 worth of inventory for your business, your inventory increase by $780, and your account payable also increases by $780.

But if you have the time to dedicate to updating your books regularly, doing your own bookkeeping may be feasible. Your general ledger should be up to date so that your bookkeeping software is able to provide functionality that you can navigate easily. QuickBooks is an excellent option for novice and seasoned digital bookkeepers alike. Bookkeeping doesn’t need to be a tedious task when you know which accounts to track and you have the right tools. To help make the process even easier and make you a pro in no time, we’ve created a handy checklist you can refer to when doing your books.

Kickstart Your Bookkeeping Journey With Your Very Own Checklist

To make it even easier, bookkeepers often group transactions into categories. This is reflected in the books by debiting inventory and crediting accounts payable. The single-entry bookkeeping method is often preferred for sole proprietors, small startups, and companies with unfussy or minimal transaction activity. The single-entry system tracks cash sales and expenditures over a period of time. Not only can this help you set goals, but it can also help you identify problems in your business.

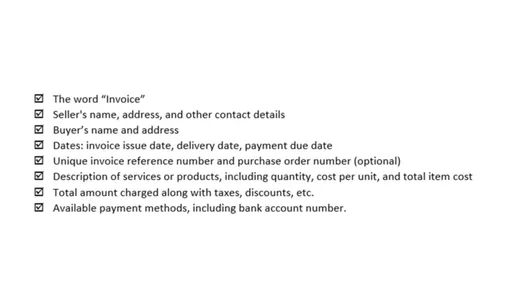

- It’s important you keep this up to date so that you can send timely and accurate bills and invoices.

- Our explanation of bookkeeping attempts to provide you with an understanding of bookkeeping and its relationship with accounting.

- In order to reduce the amount of writing in a general journal, special journals or daybooks were introduced.

These rules are called Generally Accepted Accounting Principles (GAAP). The financial transactions are all recorded, but they have to be summarized at the end of specific time periods. Other smaller firms may require reports only at the end of the year in preparation for doing taxes. Prior to computers and software, the bookkeeping for small businesses usually began by writing entries into journals. In order to reduce the amount of writing in a general journal, special journals or daybooks were introduced. The special or specialized journals consisted of a sales journal, purchases journal, cash receipts journal, and cash payments journal.

What is business accounting? 21 tips for business owners

A trial balance is an internal report that lists 1) each account name, and 2) each account’s balance in the appropriate debit column or credit column. If the total of the debit column did not equal the total of the credit column, there was at least one error occurring somewhere between the journal entry and the trial balance. Finding the one or more errors often meant spending hours retracing the entries and postings. Very small businesses may choose a simple bookkeeping system that records each financial transaction in much the same manner as a checkbook.

- Bookkeeping (and accounting) involves the recording of a company’s financial transactions.

- When you pay for the domain, your advertising expense increases by $20, and your cash decreases by $20.

- Outsourcing the work to a seasoned bookkeeper can allow you to focus on your business plan and growth.

- Remember, it’s to help both your business grow and stop HMRC from kicking up a fuss.

Bookkeeping (and accounting) involves the recording of a company’s financial transactions. The company’s transactions were written in the journals in date order. Later, the amounts in the journals would be posted to the designated accounts located in the general ledger. Examples of accounts include Sales, Rent Expense, Wages Expense, Cash, Loans Payable, etc.

Introduction to Bookkeeping

The bookkeeping transactions can be recorded by hand in a journal or using a spreadsheet program like Microsoft Excel. Most businesses now use specialized bookkeeping computer programs to keep books that show their financial transactions. Bookkeepers can use either single-entry or double-entry bookkeeping to record financial transactions. Bookkeepers have to understand the firm’s chart of accounts and how to use debits and credits to balance the books. Double-entry bookkeeping is an accounting method where each transaction is recorded in 2 or more accounts using debits and credits. A debit is made in at least one account and a credit is made in at least one other account.

If you’re unfamiliar with local and federal tax codes, doing your own bookkeeping may prove challenging. On the other hand, if you have in-depth tax and finance knowledge beyond the bookkeeping basics, you may be able to get the job done. Trying to juggle too many things at once only works to put your organization in danger. If you’re looking to convert from manual bookkeeping to digital, consider a staggered approach. Overhauling all at once can be overwhelming and discouraging, so it’s best to take it slow and make meaningful and intentional shifts.

Understanding Assets, Liabilities, and Equity When Balancing the Books

Each account’s balance had to be calculated and the account balances were used in the company’s financial statements. In addition to the general ledger, a company may have had subsidiary ledgers for accounts such as Accounts Receivable. You can hire an accountant and bookkeeper to do your business’s double-entry bookkeeping. Or, FreshBooks has a simple accounting solution for small business owners with no accounting background. Businesses that meet any of these criteria need the complete financial picture double-entry bookkeeping delivers.

Recording Transactions

Bookkeepers are responsible for recording, classifying, and organizing every financial transaction that is made through the course of business operations. The accounting process uses the books kept by the bookkeeper to prepare the end of the year accounting statements and accounts. To determine whether errors had occurred, the bookkeeper prepared a trial balance.

How to Do Bookkeeping: Basics Every Small Business Owner Needs to Know

The double-entry system of bookkeeping is common in accounting software programs like QuickBooks. With this method, bookkeepers record transactions under expense or income. Then they create a second entry to classify the transaction on the appropriate account.

If your company is larger and more complex, you need to set up a double-entry bookkeeping system. At least one debit is made to one account, and at least one credit is made to another account. You also have to decide, as a new business owner, if you are going to use single-entry or double-entry bookkeeping. You record transactions as you pay bills and make deposits into your company account.