differences in cogm and cogs

Accounting Principles II

But both of these expenses are subtracted from the company’s total sales or revenue figures. Additional costs may include freight paid to acquire the goods, customs duties, sales or use taxes not recoverable paid on materials used, and fees paid for acquisition.

Costs include all costs of purchase, costs of conversion and other costs that are incurred in bringing the inventories to their present location and condition. Costs of goods made by the businesses include material, labor, and allocated overhead. The costs of those goods which are not yet sold are deferred as costs of inventory until the inventory is sold or written down in value.

Thus, they mistakenly assume items that have been stolen have been sold and include their cost in cost of goods sold. Cost of goods sold is the inventory cost to the seller of the goods sold to customers. Cost of Goods Sold is an EXPENSE item with a normal debit balance (debit to increase and credit to decrease). Even though we do not see the word Expense this in fact is an expense item found on the Income Statement as a reduction to Revenue. Operating expenses (OPEX) and cost of goods sold (COGS) are discrete expenditures incurred by businesses.

Operating expenses (OPEX) and cost of goods sold (COGS) are separate sets of expenditures incurred by businesses in running their daily operations. Consequently, their values are recorded as different line items on a company’s income statement.

The cost of sending the cars to dealerships and the cost of the labor used to sell the car would be excluded. Because COGS is a cost of doing business, it is recorded as a business expense on the income statements. Knowing the cost of goods sold helps analysts, investors, and managers estimate the company’s bottom line. While this movement is beneficial for income tax purposes, the business will have less profit for its shareholders. Businesses thus try to keep their COGS low so that net profits will be higher.

And when you know your business’s gross profit, you can calculate your net income or profit, which is the amount your business earns after subtracting all expenses. COGS does not include indirect expenses, like certain overhead costs. Do not factor things like utilities, marketing expenses, or shipping fees into the cost of goods sold. Costs are associated with particular goods using one of the several formulas, including specific identification, first-in first-out (FIFO), or average cost.

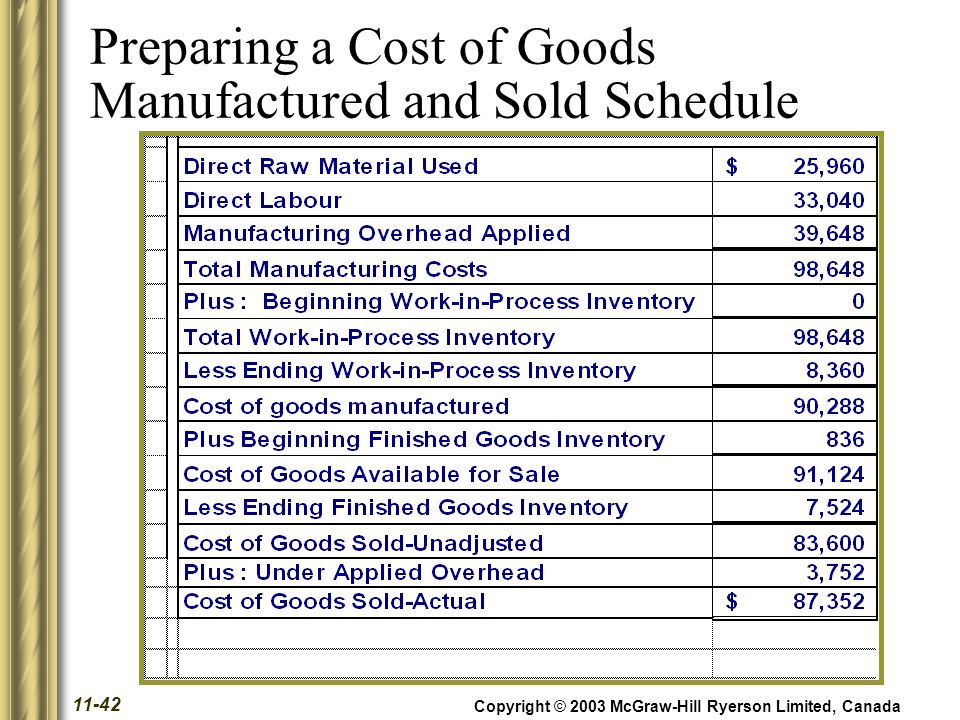

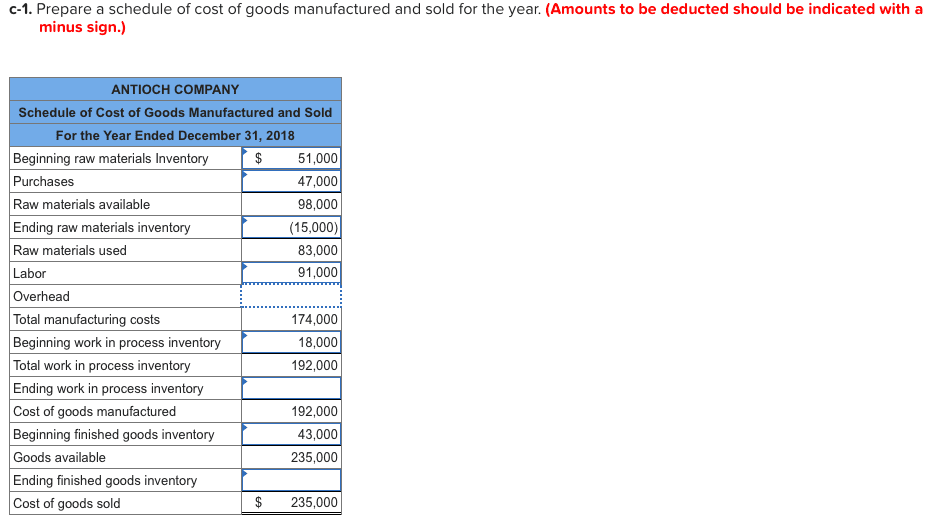

How do you prepare cost of goods manufactured?

The cost of goods manufactured schedule is used to calculate the cost of producing products for a period of time. The cost of goods manufactured amount is transferred to the finished goods inventory account during the period and is used in calculating cost of goods sold on the income statement.

If she used LIFO, the cost would be 10 plus 20 for a profit of 15. The cost of goods manufactured is a calculation of the production costs of the goods that were completed during an accounting period. Cost of goods sold (COGS) is an important line item on an income statement. It reflects the cost of producing a good or service for sale to a customer. The IRS allows for COGS to be included in tax returns and can reduce your business’s taxable income.

Cost of goods sold is the accounting term used to describe the expenses incurred to produce the goods or services sold by a company. These are direct costs only, and only businesses with a product or service to sell can list COGS on their income statement. When subtracted from revenue, COGS helps determine a company’s gross profit. The most common way to calculate COGS is to take the beginning annual inventory amount, add all purchases, and then subtract the year ending inventory from that total. She buys machines A and B for 10 each, and later buys machines C and D for 12 each.

Whether you are a traditional retailer or an online retailer, the same rules apply. In a periodic inventory system, the cost of goods sold is calculated as beginning inventory + purchases – ending inventory. The assumption is that the result, which represents costs no longer located in the warehouse, must be related to goods that were sold. Actually, this cost derivation also includes inventory that was scrapped, or declared obsolete and removed from stock, or inventory that was stolen. Thus, the calculation tends to assign too many expenses to goods that were sold, and which were actually costs that relate more to the current period.

Connect Managerial Accounting Chapter 1

- Consequently, their values are recorded as different line items on a company’s income statement.

- Operating expenses (OPEX) and cost of goods sold (COGS) are separate sets of expenditures incurred by businesses in running their daily operations.

The IRS website even lists some examples of “personal service businesses” that do not calculate COGS on their income statements. Many service companies do not have any cost of goods sold at all. COGS is not addressed in any detail ingenerally accepted accounting principles(GAAP), but COGS is defined as only the cost of inventory items sold during a given period.

Under specific identification, the cost of goods sold is 10 + 12, the particular costs of machines A and C. If she uses average cost, her costs are 22 ( (10+10+12+12)/4 x 2). Thus, her profit for accounting and tax purposes may be 20, 18, or 16, depending on her inventory method. The popularity of online markets such as eBay and Etsy has resulted in an expansion of businesses that transact through these markets.

Not only do service companies have no goods to sell, but purely service companies also do not have inventories. If COGS is not listed on the income statement, no deduction can be applied for those costs. For example, the COGS for an automaker would include the material costs for the parts that go into making the car plus the labor costs used to put the car together.

Also, the company usually does not maintain other records showing the exact number of units that should be on hand. Although periodic inventory procedure reduces record-keeping, it also reduces control over inventory items. Firms assume any items not included in the physical count of inventory at the end of the period have been sold.

Cost of goods sold (COGS) refers to the direct costs of producing the goods sold by a company. This amount includes the cost of the materials and labor directly used to create the good. It excludes indirect expenses, such as distribution costs and sales force costs.

What Does the COGS Tell You?

Thus, Jane has spent 20 to improve each machine (10/2 + 12 + (6 x 0.5) ). If she used FIFO, the cost of machine D is 12 plus 20 she spent improving it, for a profit of 13. Remember, she used up the two 10 cost items already under FIFO. If she uses average cost, it is 11 plus 20, for a profit of 14.

COGS include direct material and direct labor expenses that go into the production of each good or service that is sold. After year end, Jane decides she can make more money by improving machines B and D. She buys and uses 10 of parts and supplies, and it takes 6 hours at 2 per hour to make the improvements to each machine. She calculates that the overhead adds 0.5 per hour to her costs.

Costs of selling, packing, and shipping goods to customers are treated as operating expenses related to the sale. Both International and U.S. accounting standards require that certain abnormal costs, such as those associated with idle capacity, must be treated as expenses rather than part of inventory.

For financial reporting purposes such period costs as purchasing department, warehouse, and other operating expenses are usually not treated as part of inventory or cost of goods sold. For U.S. income tax purposes, some of these period costs must be capitalized as part of inventory.

Some businesses operate exclusively through online retail, taking advantage of a worldwide target market and low operating expenses. Though non-traditional, these businesses are still required to pay taxes and prepare financial documents like any other company.

The Internal Revenue Service allows labor costs to be considered part of cost of goods sold if the company is in the mining or manufacturing business. In these businesses, labor costs applied to cost of goods sold must be an expense directly attributable to taking raw material and fabricating it into a finished product suitable for sale. Wages, which include salaries and payroll taxes, can be considered part of cost of goods sold as long as they are direct or indirect labor costs. The cost of goods sold (COGS), also referred to as the cost of sales or cost of services, is how much it costs to produce your products or services.

They should also account for their inventories and take advantage of tax deductions like other retailers, including listings of cost of goods sold (COGS) on their income statement. Costs of revenueexist for ongoing contract services that can include raw materials, direct labor, shipping costs, and commissions paid to sales employees. These items cannot be claimed as COGS without a physically produced product to sell, however.

Cost of goods sold is the accumulated total of all costs used to create a product or service, which has been sold. These costs fall into the general sub-categories of direct labor, materials, and overhead. In a retail or wholesale business, the cost of goods sold is likely to be merchandise that was bought from a manufacturer. Under periodic inventory procedure, companies do not use the Merchandise Inventory account to record each purchase and sale of merchandise. Instead, a company corrects the balance in the Merchandise Inventory account as the result of a physical inventory count at the end of the accounting period.