How many days after a month ends should the bank reconciliation be done?

The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate. The information on the bank statement is the bank’s record of all transactions impacting the entity’s bank account during the past month. Check for any errors made by the bank’s processing department. If you’re reconciling a business cash account, your accounting is posted to general ledger.

Another item that requires an adjustment is interest earned. Interest is automatically deposited into a bank account after a certain period of time.

There may also be collected payments that have not yet been processed by the bank, which requires a positive adjustment. When your company receives the bank statement, you should print a report listing all of the checks written and deposits made during the month.

A bank reconciliation statement is a useful financial internal control tool used to thwart fraud. The bank reconciliation should be done within a few days after the month ends. At the latest, the bank reconciliation should be done prior to closing the books for the month.

If the bank charges you a fee for depositing a bad check, you will also need to deduct that amount. You will also be charged if you overdraw your account. You need to deduct all bank charges from your cash account. One type of bank charge is a monthly service charge.

Fixing bank reconciliation problems

What do you mean by bank reconciliation?

When you reconcile your business bank account, you compare your internal financial records against the records provided to you by your bank. A monthly reconciliation helps you identify any unusual transactions that might be caused by fraud or accounting errors, and the practice can also help you spot inefficiencies.

Whether it’s checks, ATM transactions, or other charges, subtract these items from the bank statement balance. Note charges on your bank statement that you haven’t captured in your internal records. If you’re not using accounting software, your financial transactions will appear on your paper check register, credit card statements, and bank statements. If you’re using accounting softwareto print batches of checks each time the company pays bills, your transactions will be recorded on your software’s account register. To prepare a bank reconciliation, gather your bank statement and a list of all of your recent transactions.

Bank reconciliation statements ensure payments have been processed and cash collections have been deposited into the bank. The reconciliation statement helps identify differences between the bank balance and book balance, in order to process necessary adjustments or corrections. An accountant typically processes reconciliation statements once a month. Check that all outgoing funds have been reflected in both your internal records and your bank account.

You also need to adjust your cash records for interest earned on your bank account balance. These definitions are different from how the accounting profession uses these terms.

Thus, the accountant may need to prepare an entry that increases the cash currently shown in the financial records. After all, adjustments are made to the books, the balance should equal the ending balance of the bank account. If the figures are equal, a successful bank reconciliation statement has been prepared.

A business should compare the cash account’s general ledger to the bank statement activity. You may come across a transaction that you cannot fully explain.

What is bank reconciliation?

- A bank reconciliation is a critical tool for managing your cash balance.

- Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement.

If you’re unclear about a business or personal bank transaction, contact your bank. A bank reconciliation statement is a summary of banking and business activity that reconciles an entity’s bank account with its financial records. The statement outlines the deposits, withdrawals and other activities affecting a bank account for a specific period.

The reconciliation process also helps you identify fraud and other unauthorized cash transactions. As a result, it is critical for you to reconcile your bank account within a few days of receiving your bank statement. The accountant adjusts the ending balance of the bank statement to reflect outstanding checks or withdrawals. These are transactions in which payment is en route but the cash has not yet been accepted by the recipient. When preparing the Oct. 31 bank reconciliation statement, the check mailed the previous day is unlikely to have been cashed, so the accountant deducts the amount from the bank balance.

How to do bank reconciliation the easy way

How do I do a bank reconciliation?

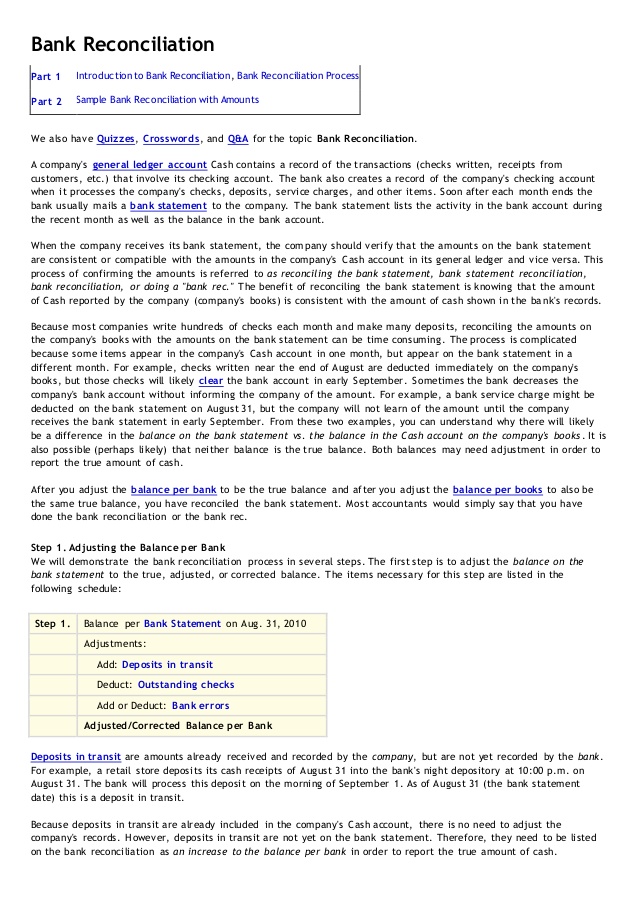

A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement. The goal of this process is to ascertain the differences between the two, and to book changes to the accounting records as appropriate.

Zuora recommends that you find the report name for payments in each gateway and refer to that name. The bank reconciliation might reveal that some revenues and/or receipts were electronically deposited into the bank account but were not yet recorded in the accounting records. Likewise, there might be some expenses and/or payments that were deducted electronically from the bank account, but were not yet entered into the company’s accounts.

You may also be charged if you overdraw your account balance. Most of these charges are posted to your bank statement, but may not be posted to your cash account at month-end.

If you find an error on the bank’s part, contact them as soon as possible to let them know about the discrepancy. Cash and/or checks that have been received and recorded by an entity, but which have not yet been recorded in the records of the bank where the entity deposits the funds. If this occurs at month-end, the deposit will not appear in the bank statement, and so becomes a reconciling item in the bank reconciliation. Payment reconciliation is the process of checking your bank statements against your accounting and Zuora records to ensure the payment amounts match. You can sort successful payments by day and credit card type, which makes it easier to reconcile your payment gateway.

Bank reconciliation steps

The balance of the cash account in an entity’s financial records may require adjusting as well. For instance, a bank may charge a fee for having the account open. The bank typically withdraws and processes the fees automatically from the bank account. Therefore, when preparing a bank reconciliation statement, any fees taken from the account must be accounted for by preparing a journal entry.

Further, the bank reconciliation might reveal some errors in the transactions already recorded in the company’s general ledger. A bank reconciliation statement summarizes banking and business activity, reconciling an entity’s bank account with its financial records. Reconciling accounts and comparing transactions also helps your accountant produce reliable, accurate, and high-quality financial statements. If the bank statement indicates that a “not sufficient funds” check bounced during the month, that means that the check amount was not deposited to your account. You will have to deduct the check amount from your cash account records.

essentials to do before starting a business

A company will probably have accounting software that can provide reports.If you’re reconciling your personal bank account, you should review your check register and your deposit slips. A company should print the cash reports, and also review the check register and deposit slips. A bank reconciliation is the process of matching the balances in an entity’s accounting records for a cash account to the corresponding information on a bank statement.

A bank reconciliation is a critical tool for managing your cash balance. Reconciling is the process of comparing the cash activity in your accounting records to the transactions in your bank statement. This process helps you monitor all of the cash inflows and outflows in your bank account.