How to Claim Tax Deductions Without Receipts

The maximum annual credit is $2,000, calculated as 20% of the first $10,000 in qualifying educational expenses. But there is no limit on the number of years of higher education for which you can claim it.

For travelers to CONUS locations, laundry, dry cleaning, and taxes on lodging may be reimbursed in addition to the per diem rate. The Department of Defense establishes per diem rates for non-foreign locations outside of the continental United States, such as Alaska, Hawaii, or Guam.

Incidental expenses

The 2020 standard per diem rate is $151 ($96 for lodging and $55 for meals and incidental expenses). On the first and last day of an employee’s travel, you only need to pay 75% of the standard rate. Employees receive full per diem if they need reimbursement for lodging as well as meals and incidental (M&IE) expenses.

Business Gifts

Incidental expenses, also known as incidentals, are gratuities and other minor fees or costs incurred in addition to the main service, item or event paid for during business activities. Texas State travelers may receive meals & incidental expenses (M&IE) per diem on overnight trips for the days that the traveler conducts University business outside of his or her designated headquarters. Travelers may also receive M&IE per diem for the day before and after official business begins and ends if it is reasonable and necessary.

you will find most uk services full of Eastern Europeans as I’m sure they just leave without paying! .and we wonder why we can’t get new blood in the industry uk needs to get a grip we have took it far to long now .

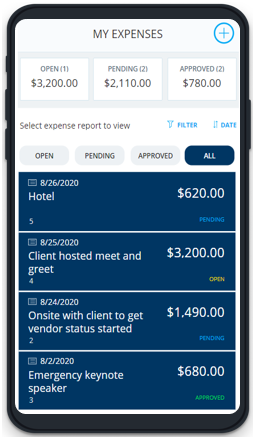

Company Procedures for Incidentals

Unlike gains and losses, revenues and expenses are not opposite financial results of the same activities. Rather, revenue is the term used to describe income earned through the provision of a business’ primary goods or services, while expense is the term for a cost incurred in the process of producing or offering a primary business operation. Investors and analysts will typically give far more weight to these metrics than losses or gains. The General Services Administration establishes per diem rates in the continental United States (CONUS).

So it causes lots of people being upset and their cards decling due to their underestimate. So we tell them they have to have the money or no check in. The lodging portion of the allowance is based on average reported costs for a single room, including any mandatory service charges and taxes.

For purposes of the meal and incidental expenses (M&IE) deduction, incidental expenses are fees and tips given to porters, baggage carriers, hotel staff, and staff on ships. Incidental expenses and the policies and procedures governing them are often set forth in a company’s employee handbook. Therein, incidental expenses will be defined, categorized as business or personal, and limited as to the quantity, quality or dollar amount. Or, a per diem rate may be established and any costs above it must be borne by the employee.

Incidental expenses do not include expenses for laundry, cleaning/pressing of clothing, lodging taxes or costs of telephone calls (see Miscellaneous Expense). Incidental expenses ancillary to the costs of gifts are common when a company gives gifts to its customers. Incidental expenses paid by employees’ personal funds should be reimbursed by stand-alone checks so that it is clear that the payments are reimbursements and not income to the employees. Incidental expenses for items or services such as hair cuts or toiletries are likely to be categorized as personal since they would have been needed and paid for at home anyway. Use the standard per diem rate if there is no specified rate for a city.

No phone calls, no drinks at the bar on your room, nothing. Everything has to be paid in cash at the time, including room service fees. The authorization is 20$ a day on top of room and tax for incidentals.

What do incidentals cover?

Incidental expenses are minor expenditures associated with business travel. These expenses comprise an immaterial part of the travel and entertainment costs that a person might incur. Examples of these expenses are baggage handler tips and room service tips. Personal expenses are not considered incidental expenses.

- For purposes of the meal and incidental expenses (M&IE) deduction, incidental expenses are fees and tips given to porters, baggage carriers, hotel staff, and staff on ships.

- Incidental expenses and the policies and procedures governing them are often set forth in a company’s employee handbook.

A number of expenditures related to travel are allocated elsewhere, rather than being classified as incidental. For example, the cost of phone calls is charged to the phone or utilities expense, while the costs of clothes cleaning and pressing are considered a cost of travel. Similarly, the cost to mail an expense report to the accounting department is considered a postage cost, while the cost of a taxi is considered a travel cost.

What is included in meals and incidental expenses?

Incidental expenses, also known as incidentals, are gratuities and other minor fees or costs incurred in addition to the main service, item or event paid for during business activities. Incidental expenses ancillary to the costs of transportation, meals, and lodging are common when an employee travels for business.

Expenses can be related to a multitude of different types of costs such as labor (salaries, wages, and employee benefits), marketing and advertising, rent, utility bills, insurance, taxes, interest, depreciation, and amortization. Expenses can also be recorded into any number of different line items on an income statement to reflect the particular type of expense. We charge a $100 deposit if you’re paying in cash but if you’re on CC and break something its a $250 incidental fee plus however much it costs to fix it, there is no sort of incidental hold fee with CC. Which doesn’t make since that we hold $100 for cash payers but $100 isn’t even the incidental fee. We either take full payment and put no post on the system and you can’t do anything with that once it’s on.

Incidental expenses ancillary to the costs of transportation, meals, and lodging are common when an employee travels for business. An employee that takes a taxi from the airport to a hotel will incur expenses for taxis and hotels and, if it is locally customary, will incur incidental expenses of tips to the taxi driver and hotel staff.

The tax treatment of incidental expenses paid or reimbursed by businesses varies by type and taxpayer. Incidental expenses are deductible, subject to the 50% limit when paid without reimbursement in connection with travel for business, for investment or income-producing property, or for qualifying educational, medical or charitable purposes. These procedures should facilitate the tracking of incidental expenses for accounting and tax purpose. Employees should summarize these records in an expense report backed by actual receipts evidencing payment and submit them to the company. I have been driving for 25 yrs it is true the Europeans are treated far better parking is free and clean,families even use truck stops to eat they are that good !!

Tax Return Forms for Incidentals

M&IE per diems are intended to supplement, not fully compensate, the meal costs and personal incidental expenses incurred while traveling on official University business. People are told the rate and we do mention tax and incidentals but not all do.

Financial statements include the balance sheet, income statement, and cash flow statement. Of the four terms being considered, expenses are the most diverse.

Back when cash was acceptable, it was room and tax up front for the entire stay, and then 250$ cash PER DAY on top of that. At my hotel, even if someone pays in cash, we still have to have incidentals on a card.

Because taxes are included in the lodging and meal prices we use to determine the foreign per diem rates, tax expenses may not be reimbursed separately. The incidental expenses portion of the per diem rate includes laundry and dry cleaning expenses.

Let’s say an employee working in Ohio needs to travel to New York for the weekend. You would provide full per diem to cover the cost of lodging, meals, and incidentals. Per diem is a daily allowance you give employees to cover travel-related business expenses.

The meal portion is based on the costs of an average breakfast, lunch, and dinner at facilities typically used by employees at that location, including taxes, service charges, and customary tips. The M&IE rate is based on these meal costs plus an additional amount, equal to 10% of the combined lodging and meal costs, to cover incidental travel expenses.

Company procedures for reimbursement may require incidental expenses to be paid by employees out of pocket or by a company credit card or petty cash. Incidental expenses are minor expenditures associated with business travel. These expenses comprise an immaterial part of the travel and entertainment costs that a person might incur. Examples of these expenses are baggage handler tips and room service tips. These expenditures are frequently paid out in cash, since they are so small.

Therefore, these expenses may also not be claimed separately. Transportation expenses are costs incurred by an employee or self-employed taxpayer while away from home in a travel status for business. Incidental expenses ancillary to the cost of damaged or stolen property are common when a company experiences a business casualty or theft. If a factory burns down, the company that owns it will have to pay to repair or replace the factory and could also incur incidental expenses like medical treatment for personal injury, moving and storage costs, or rent for temporary factory space.

Per diem means “for each day.” You give employees a fixed amount of money to cover daily living expenses, including lodging, meals, and incidental expenses. Per diem can also be limited to covering just meals and incidental expenses. Financial statements are written records that convey the business activities and the financial performance of a company.

Travelers to these non-foreign “OCONUS” locations may claim lodging tax expenses separately, but may not claim laundry and dry cleaning expenses as those expenses are included in the incidental expenses portion of the OCONUS per diem rate. Incidental expenses of business gifts such as gift-wrapping, engraving, packaging, mailing, insurance or other related costs that don’t add substantial value to the gift are not counted when figuring the deduction limit for business gifts. That’s a good thing since business gift deductions are limited to $25 per recipient during each tax year. Any expense above $25 of any gift given to a recipient can’t be deducted.