Master budget: Master Budget Explained: Component, Examples, and How to Prepare

If there are significant deviations from the budget, revising it to reflect the new information may be necessary. The management group at Jerry’s Ice Cream is reconvening to discuss sales growth anticipated for the next budget period. The company expects to collect 70 percent of sales in the quarter of sale, 25 percent of sales in the quarter following the sale, and 5 percent will not be collected (bad debt). Accounts receivable at the end of last year totaled $200,000, all of which will be collected in the first quarter of this coming year. Figure 9.11 “Cash Budget for Jerry’s Ice Cream” shows the cash budget for Jerry’s Ice Cream. Amounts shown in parentheses represent cash outflows; amounts without parentheses represent cash inflows.

They can take necessary steps to manage their cash flow, such as delaying payments or arranging short-term financing. Spreadsheets help managers perform what-if analysis by linking the components of the master budget and automatically making changes to budget schedules when certain estimates are revised. For short-term planning, you can simply multiply the number of units to be sold from each product times their price. Keep in mind that both quantity and price estimates for the future depend on the company’s strategy and objectives. However, many businesses do not have dedicated financial staff or may not have the experience necessary to create an adequate budget. A lack of communication between departments can also pose a challenge when preparing a master budget.

Master Budget vs. Flexible Budget

The cost of goods sold budget will be used to monitor production costs and ensure the company maintains profitability. The manufacturing budget includes all the costs involved in manufacturing the number of products specified in the production budget. The manufacturing budget is crucial for managing production costs, optimizing production efficiency, and achieving profit margins. The best time to prepare a master budget depends on the business’s fiscal year and financial planning cycle. Most businesses prepare their budgets annually, while others do it quarterly or bi-annually. Ideally, businesses should start preparing their master budget at least three months before the start of the fiscal year.

A master budget is a comprehensive financial plan that integrates all lower-level budgets and provides an overview of a business’s financial activities for one year, usually one year. The master budget includes budgets for revenue, expenses, capital expenditures, and cash flow. It serves as a roadmap for the business’s financial activities and guides the decision-making process of managers and executives. An example of how to use Excel to develop an operating budget for Jerry’s Ice Cream follows. The first tab is for the sales budget worksheet, the second tab is for the production budget worksheet, the next tab is for the direct materials purchases budget worksheet, and so on.

Smaller organizations usually construct their master budgets using electronic spreadsheets. However, spreadsheets may contain formula errors, and also have a difficult time constructing a budgeted balance sheet. Larger organizations use budget-specific software, which does not have these two problems. A master budget is the central planning tool that a management team uses to direct the activities of a corporation, as well as to judge the performance of its various responsibility centers.

Company

If you don’t flesh out what you’re going to spend on each part of the business, you’re probably not putting your money to use strategically. “A lot of people think budgeting is penny-pinching, but that’s not really what it is,” says Steve Lord, a managing director at financial services firm Burkland. This chapter cannot cover all areas of budgeting in detail—entire books have been written on budgeting.

- The F&O Business Office then uploaded this information to formulate the division’s budget.

- It considers the expected product demand, production capacity, and inventory levels.

- Prior to 2000, activity managers were required to use Excel to process budget information.

- This budget assigns a value to every unit of product produced based on raw materials, direct labor, and overhead.

First, it provides a holistic view of the organization’s financial activities, enabling managers and executives to make informed decisions based on the available financial resources. Second, it helps businesses align their financial goals with their strategic objectives. By preparing a master budget, businesses can determine their financial priorities and allocate resources accordingly. The bottom section of the cash budget is where the ending cash balance is calculated for each budget period.

Direct Labor Budget

Still, if most of its revenue is tied up in accounts receivable, it may not have enough cash to cover its expenses. To avoid this mistake, businesses should carefully consider their cash flow projections and ensure they have enough cash to cover their expenses. Fifth, they need strong organizational skills to manage the budgeting process effectively.

- ABC Manufacturing Company is preparing its master budget for the next fiscal year.

- Changes in regulations or internal policies can impact a business’s financials, and the master budget must be adjusted accordingly.

- Any item that is not in cash, such as depreciation, is ignored by the cash budget.

- Quarterly updates allow businesses to adjust their budgets based on actual financial performance and changes in the market or competition.

- An example of how to use Excel to develop an operating budget for Jerry’s Ice Cream follows.

- Unit sales are expected to increase 25 percent, and each unit is expected to sell for $8.

The master budget is typically presented in either a monthly or quarterly format, and usually covers a company’s entire fiscal year. There may also be a discussion of the headcount changes that are required to achieve the budget. The pro forma income statement is a company’s forecasted income statement that combines sales revenue with other budget costs.

Cash Collections from Sales

Cloud-based tools provide businesses the flexibility and convenience of accessing their financial data anytime. Cloud-based software can be accessed via the internet, making it easier for businesses to collaborate and share financial data. These tools also provide real-time updates, reducing the risk of errors and ensuring accuracy. That outlines the steps required to achieve the strategic goals that should be developed.

Supports Strategic Planning

Depending on the business’s size, complexity, and financial planning cycle, the master budget can be updated monthly, quarterly, or annually. Creating a master budget is a complex process requiring a skilled professional team. Another benefit of a master budget is that it helps businesses manage their cash flow effectively. By projecting their cash inflows and outflows, businesses can determine when they may experience cash shortages or surpluses.

What Are the Ethical Considerations Businesses Should Keep in Mind When Preparing Their Master Budget?

If different departments have conflicting goals or are not aligned in their projections, it can create a disconnect in the budgeting process. By using the master budget as a guide, the company can make informed financial decisions that will help it succeed in a competitive marketplace. The operating expenses budget encompasses administrative and sales-related costs, such as advertising or marketing. The operating expenses budget is essential for managing day-to-day expenses, optimizing cost structures, and achieving profitability targets.

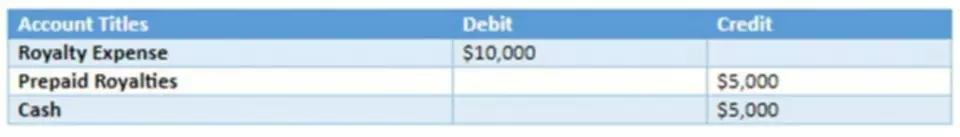

It shows the total amount that a company plans to generate by selling (or acquiring) fixed assets such as machinery, plants, or cars. Retained earnings at the end of last year totaled $56,180, and no cash dividends are anticipated for the budget period ending December 31. Here are a couple examples of budgets you’d find inside a master budget (all numbers are hypothetical). It should be reviewed, assessed, and updated on (at least) a quarterly basis to see how things are going. Look at the resources your company has, figure out where the gaps are, and help suss out realistic budget numbers based on time and resource constraints. Budgets allow business leaders to have informed conversations about the company’s expenses.