Meaning of depreciation: What Is Depreciation in Accounting How to Calculate

For example, a small company may set a $500 threshold, over which it depreciates an asset. On the other hand, a larger company may set a $10,000 threshold, under which all purchases are expensed immediately. The group depreciation method is used for depreciating multiple-asset accounts using a similar depreciation method. The assets must be similar in nature and have approximately the same useful lives. Accumulated depreciation is the total depreciation of the fixed asset accumulated up to a specified time. Stretching deductions over time reduces their present value, which means companies are unable to fully recover the cost of their investment in real terms, even when the deductions nominally add up to the investment cost.

In accounting terms, depreciation is defined as the reduction of the recorded cost of a fixed asset in a systematic manner until the value of the asset becomes zero or negligible. Tax depreciation follows a system called MACRS, which stands for modified accelerated cost recovery system. MACRS is a form of accelerated depreciation, and the IRS publishes tables for each type of property. Work with your accountant to be sure you’re recording the correct depreciation for your tax return.

How the CARES Act Shifted the Composition of Tax Expenditures Towards Individuals

Most income tax systems allow a tax deduction for recovery of the cost of assets used in a business or for the production of income. Where the assets are consumed currently, the cost may be deducted currently as an expense or treated as part of cost of goods sold. The cost of assets not currently consumed generally must be deferred and recovered over time, such as through depreciation. Some systems permit the full deduction of the cost, at least in part, in the year the assets are acquired. Other systems allow depreciation expense over some life using some depreciation method or percentage.

- Depreciation is a measurement of the “useful life” of a business asset, such as machinery or a factory, to determine the multiyear period over which the cost of that asset can be deducted from taxable income.

- However, in most countries the life is based on business experience, and the method may be chosen from one of several acceptable methods.

- Depreciation calculations require a lot of record-keeping if done for each asset a business owns, especially if assets are added to after they are acquired, or partially disposed of.

- When a company buys an asset, it records the transaction as a debit to increase an asset account on the balance sheet and a credit to reduce cash (or increase accounts payable), which is also on the balance sheet.

But the depreciation charges still reduce a company’s earnings, which is helpful for tax purposes. When an asset is sold, debit cash for the amount received and credit the asset account for its original cost. Under the composite method, no gain or loss is recognized on the sale of an asset. Theoretically, this makes sense because the gains and losses from assets sold before and after the composite life will average themselves out.

Composite depreciation method

As such, the company’s accountant does not have to expense the entire $50,000 in year one, even though the company paid out that amount in cash. The company expenses another $4,000 next year and another $4,000 the year after that, and so on until the asset reaches its $10,000 salvage value in 10 years. The depreciation rate is used in both the declining balance and double-declining balance calculations.

- Keep in mind, though, that certain types of accounting allow for different means of depreciation.

- Depreciation is what happens when assets lose value over time until the value of the asset becomes zero, or negligible.

- The ideal is for an asset to be depreciated according to how it actually loses value, but this calculation would be hard to make for many assets.

- We believe everyone should be able to make financial decisions with confidence.

- Here are four common methods of calculating depreciation, along with when it’s best to use them.

Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

Three Reasons Why Full Cost Recovery Is Right Even if Assets Increase in Value

Depreciation refers to the reduced value of something over time due to wear and tear. Many items, from appliances to major construction machinery, lose value over time and eventually must be replaced. The four methods described above are for managerial and business valuation purposes. Depreciation measures the value an asset loses over time—directly from ongoing usage through wear and tear and indirectly from the introduction of new product models and factors like inflation.

After taking the reciprocal of the useful life of the asset and doubling it, this rate is applied to the depreciable base—its book value—for the remainder of the asset’s expected life. Depreciation calculations require a lot of record-keeping if done for each asset a business owns, especially if assets are added to after they are acquired, or partially disposed of. However, many tax systems permit all assets of a similar type acquired in the same year to be combined in a “pool”. Depreciation is then computed for all assets in the pool as a single calculation.

Help us achieve our vision of a world where the tax code doesn’t stand in the way of success.

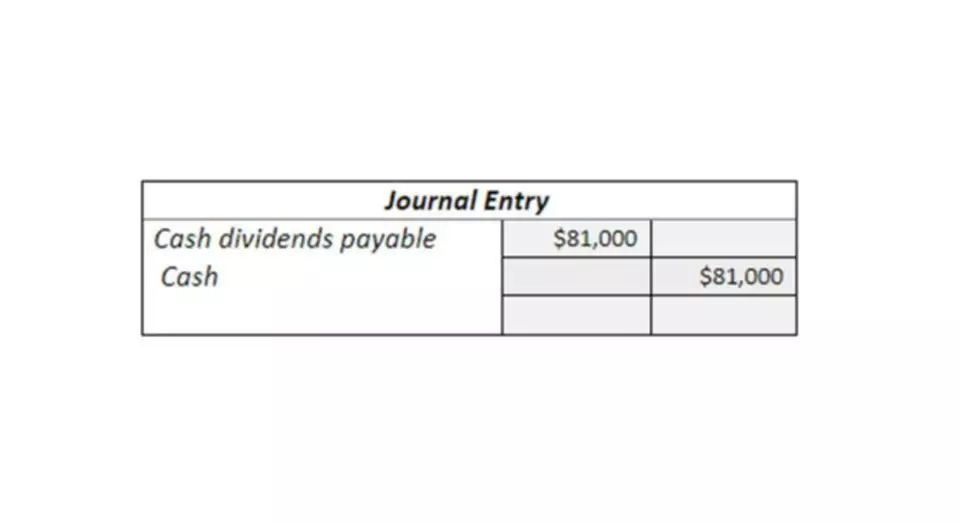

Neither journal entry affects the income statement, where revenues and expenses are reported. In determining the net income (profits) from an activity, the receipts from the activity must be reduced by appropriate costs. Depreciation is any method of allocating such net cost to those periods in which the organization is expected to benefit from the use of the asset. Depreciation is a process of deducting the cost of an asset over its useful life.[3] Assets are sorted into different classes and each has its own useful life.

What Is Depreciation? Definition, Types, How to Calculate

Depletion and amortization are similar concepts for natural resources (including oil) and intangible assets, respectively. Many or all of the products featured here are from our partners who compensate us. This influences which products we write about and where and how the product appears on a page. Depreciation schedules can range from simple straight-line to accelerated or per-unit measures.

Tax lives and methods

Because companies don’t have to account for them entirely in the year the assets are purchased, the immediate cost of ownership is significantly reduced. Companies can also depreciate long-term assets for both tax and accounting purposes. By including depreciation in your accounting records, your business can ensure that it records the right profit on the balance sheet and income statement. As depreciation is a highly complex area, it’s always a good idea to leave it to the experts.

Accumulated depreciation is commonly used to forecast the lifetime of an item or to keep track of depreciation year-over-year. Depreciation is often what people talk about when they refer to accounting depreciation. This is the process of allocating an asset’s cost over the course of its useful life in order to align its expenses with revenue generation. Different companies may set their own threshold amounts for when to begin depreciating a fixed asset or property, plant, and equipment (PP&E).