What is a pay stub: How to Read A Pay Stub Information, Earnings & Deductions How to Read Your Pay Stub IRIS FMP

A pay statement is a document that summarizes an employee’s gross pay, taxes and deductions, and net pay. It can be provided in printed format with a paycheck or made available electronically. In some states, employees must consent to receive electronic pay statements. The stub is something the employee can use to confirm what funds were withheld from the gross pay that led to the final net pay amount. There is no federal law that requires employers to provide employees with pay stubs, though most states do require employers to provide a pay stub.

- There may be other deductions as well, depending on the programs that you sign up for with your employer.

- Deductions shows any additional deductions that might be taken out of your paycheck after tax, like group life or disability insurance.

- Get up and running with free payroll setup, and enjoy free expert support.

- Pay stubs should outline things such as tax withholdings, health insurance payments and retirement funding.

- You were likely given access to it along with login information when you were initially hired.

But, it does not require that employers share this information with their employees. Some red flags to look out for on your pay stub include the misspelling of key personal information such as your name or Social Security number. Other red flags can include no tax withholdings or inconsistent pay. It is good practice to review your pay stub when received and make sure there are no discrepancies. The principle behind federal income tax is that the government withholds a certain percentage of the money you earn in a year. However, that percentage can be fiendishly difficult to calculate for any individual.

What is a pay stub?

If you’re hiring international talent, you need to know what’s required by law in each country or state your employees work from. A pay stub is a document issued by an employer that shows an employee’s gross earnings, deductions from those earnings, and net pay. Pay stubs are created in conjunction with paychecks, so each employee gets a new pay stub for each pay period. Employees who receive printed paychecks generally find their pay statement attached to the check.

Find out more about international payroll, and HR and payroll in the US. Omnipresent makes it easy to hire, pay, and support your international team. The information on this page is for informational purposes only and is not to be construed as legal advice.

What Is a Pay Stub?

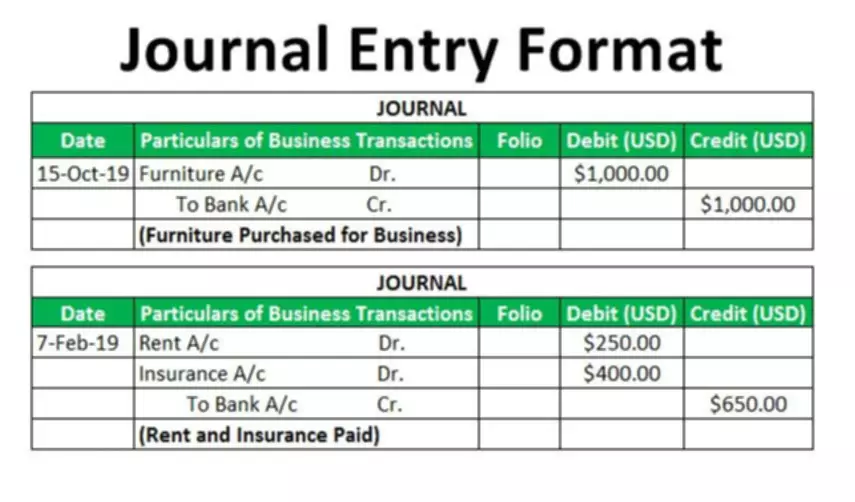

You can use special payroll software to generate professional-looking paycheck stubs for your employees. There are many free tools available, as well as premium packages. Most payroll providers will create the pay stub for you when processing your payroll. When using a paid or free payroll tool, you’ll enter in the required information in each area of the pay stub.

Pay stubs in the U.S. vary according to how they are generated, but most contain a number of key features, including your pay, taxes, and deductions. It’s important to ensure that this information is correct, but not enough people make an effort to do so. Doing your own calculations—or verifying the accuracy of those performed by the IRS—can save you (or your employer) from making a costly mistake. All the information on your pay stub is important to insure you are being compensated correctly. Be sure to review all the parts of your pay stub including deductions, withholdings, and earnings frequently to make sure you are all your money is going where it is supposed to go.

Employer Taxes & Contributions

Personal and Check information includes your personal information, filing status (single or married), as well as the withholding number, according to your IRS form W-4. As an employee, seeing your take home pay and what was taken out for tax purposes can be beneficial. You can use it as a guide when creating a budget to properly understand how much is coming in and where your money is going. Employers may also make deductions for things like insurance premiums or loans that the employee benefits from. For an hourly worker, simply multiply their hourly pay rate by the number of hours worked during the pay period. Rippling, Gusto and OnPay are three of the best payroll processing service providers available to employers.

By partnering with Omnipresent, you can enjoy a smooth onboarding process, simple payroll, and benefits management. Now we’ve covered what a pay stub is and how to read one, let’s answer some of your most frequently asked questions. Payslips can also be useful for preventing and resolving disputes between the employee and the employer about pay.

Pay Stub FAQs

Let’s take a closer look at what a pay stub is and what it includes. The Fair Labor Standards Act (also known as the FLSA) requires business owners to track their employees’ hours, but how they track that time is ultimately up to them. But while pay stubs aren’t mandated under federal law, they are required by the majority of states—including California.

Just like gross wages, information on deductions should be included for both the individual pay period and year-to-date. Be sure to check that the information on your last pay stub of the year matches the information on your W-2 form, which details your wages and taxes paid for the year. Under federal law, each worker contributes 6.2% of their gross income directly into the Social Security fund, and every employer adds an extra 6.2% for each employee. The federal government requires every working American to contribute a portion of their paycheck to Social Security, a system of supplemental retirement programs established in 1935. The Social Security fund provides benefits to current Social Security recipients.

Online accounting with Xero

In a payroll period, the taxes deducted from a paycheck typically include Social Security and Medicare taxes, otherwise known as FICA (Federal Insurance Contributions Act). The following taxes and deductions are what you can expect to see on your paycheck, explained in detail below. If you’re an employee, you can usually access pay stubs via email or through your company’s payroll portal if they have one.