Why is prepaid insurance a short term asset?

Prepaid rent expense exists as an asset account that indicates the amount of rent a company has paid in advance. After a prepaid rent expense gets recorded in the general journal, a company must make an adjustment to indicate the amount of rent used during a specific period of time. Rent is the amount paid for the use of property not owned by the company, as explained by the Internal Revenue Service website. The calculation of prepaid rent expenses depends on the amount of a company’s monthly rent. For instance, a company that prepays $12,000 for a one-year lease must credit cash for $12,000 and debit prepaid rent for the same amount.

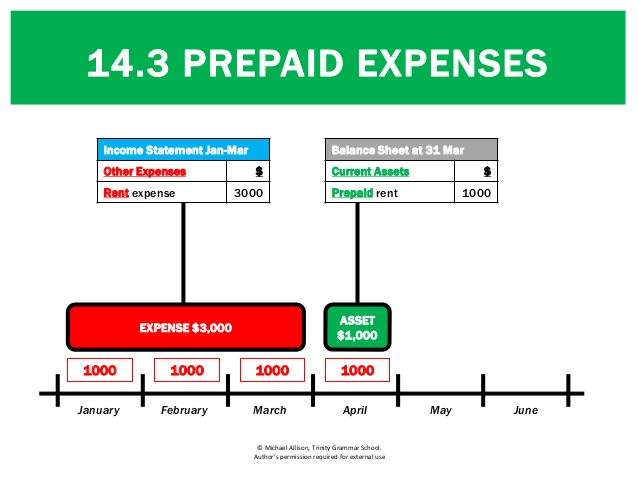

While some accounting systems can automate the amortization of the prepaid, a review of the account should occur every accounting period. For instance, a company that pays $1,000 a month for rent must credit the prepaid rent expense account for $9,000, as of September 30th. This indicates the company has three months or $3,000 of prepaid rent left to use.

The expense would show up on the income statement while the decrease in prepaid rent of $10,000 would reduce the assets on the balance sheet by $10,000. Accounting for prepaid rent doesn’t have to be complicated, but it does require attention at month-end-close. In a basic general ledger system, an accountant or bookkeeper records a prepaid asset to a balance sheet account. This may require an adjusting entry to reclass rent expense to a prepaid account. Going forward, a monthly entry will be booked to reduce the prepaid expense account and record rent expense.

A prepaid expense is a type of asset on the balance sheet that results from a business making advanced payments for goods or services to be received in the future. Prepaid expenses are initially recorded as assets, but their value is expensed over time onto the income statement. Unlike conventional expenses, the business will receive something of value from the prepaid expense over the course of several accounting periods. For example, assume ABC Company purchases insurance for the upcoming twelve month period. ABC Company will initially book the full $120,000 as a debit to prepaid insurance, an asset on the balance sheet, and a credit to cash.

How to Calculate Prepaid Rent Expenses

Therefore, it should be recorded as a prepaid expense and allocated out to expense over the full twelve months. If the rented space was used to manufacture goods, the rent would be part of the cost of the products produced. To create your first journal entry for prepaid expenses, debit your Prepaid Expense account.

The adjusting journal entry for a prepaid expense, however, does affect both a company’s income statement and balance sheet. The adjusting entry on January 31 would result in an expense of $10,000 (rent expense) and a decrease in assets of $10,000 (prepaid rent).

What are Prepaid Expenses?

Each month, an adjusting entry will be made to expense $10,000 (1/12 of the prepaid amount) to the income statement through a credit to prepaid insurance and a debit to insurance expense. In the twelfth month, the final $10,000 will be fully expensed and the prepaid account will be zero. According to generally accepted accounting principles (GAAP), expenses should be recorded in the same accounting period as the benefit generated from the related asset. For example, if a large Xerox machine is leased by a company for a period of twelve months, the company benefits from its use over the full time period. Recording an advanced payment made for the lease as an expense in the first month would not adequately match expenses with revenues generated from its use.

- Prepaid rent expense exists as an asset account that indicates the amount of rent a company has paid in advance.

Since the prepayment is for six months, divide the total cost by six ($9,000 / 6). DateAccountNotesDebitCreditX/XX/XXXXExpenseXPrepaid ExpenseXLet’s say you prepay six month’s worth of rent, which adds up to $6,000.

Prepaid rent accounting

Prepaid expenses are recorded in the books at the end of an accounting period to show true numbers of a business. Rent is a sum of money an individual or corporate tenant pays a landlord on a periodic basis, such as every month or quarter. When a corporate tenant pays rent, a bookkeeper debits the office rent expense account and credits the cash account.

When you prepay rent, you record the entire $6,000 as an asset on the balance sheet. Each month, you reduce the asset account by the portion you use. You decrease the asset account by $1,000 ($6,000 / 6 months) and record the expense of $1,000. The benefits of expenses incurred are carried to the next accounting period.

Is prepaid rent a current or noncurrent asset?

The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

Crediting the account decreases your Cash or Checking account. Noncurrent assets are a company’s long-term investments for which the full value will not be realized within the accounting year. Examples of noncurrent assets include investments in other companies, intellectual property (e.g. patents), and property, plant and equipment.

As each month passes, one rent payment is credited from the prepaid rent asset account, and a rent expense account is debited. This process is repeated as many times as necessary to recognize rent expense in the proper accounting period. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash.

These are both asset accounts and do not increase or decrease a company’s balance sheet. Recall that prepaid expenses are considered an asset because they provide future economic benefits to the company.

This account is an asset account, and assets are increased by debits. Credit the corresponding account you used to make the payment, like a Cash or Checking account.

Is prepaid rent income?

Prepaid rent is rent paid prior to the rental period to which it relates, so the tenant should record on its balance sheet the amount of rent paid that has not yet been used. Rent is commonly paid in advance, being due on the first day of that month covered by the rent payment.

Crediting the prepaid rent expense account causes a decrease in the account while a debit to prepaid rent expense causes an increase. Notice in each transaction, every debit entry has a matching credit entry for the same dollar amount. DateAccountNotesDebitCreditX/XX/XXXXPrepaid Expense9000Cash9000As each month passes, adjust the accounts by the amount of rent you use.

At the end of each accounting period, a journal entry is posted for the expense incurred over that period, according to the schedule. This journal entry credits the prepaid asset account on the balance sheet, such as Prepaid Insurance, and debits an expense account on the income statement, such as Insurance Expense. When there is a payment that represents a prepayment of an expense, a prepaid account, such as Prepaid Insurance, is debited and the cash account is credited. This records the prepayment as an asset on the company’s balance sheet. An amortization schedule that corresponds to the actual incurring of the prepaid expenses or the consumption schedule for the prepaid asset is also established.